Corporate Finance

Unmanned platform systems

Defense Industry

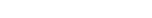

The Defense Industry is facing a significant break in direction electronic warfare and unmanned platform systems. Therefore the programming of complex algorithms in conjunction with Artificial Intelligence is becoming more and more important.

This applies in particular to the time delay in satellite control and the fast preparation of the exorbitant data volume (Autonomous Real-Time Ground Ubiquitous Surveillance Imaging System).

Scope of the work: Identification and acquisition of specialized small and medium privately owned IT Companies in Europe together with an investment bank on behalf of a globally leading defense company.

Four major companies were finally acquired.

Corporate Finance

Investment, Concept and Implementation - 3D printing start-up

IT / Manufacturing Industry

In Small and Medium Enterprises the capabilities and performance of 3D printing processes and materials are often still unclear. At the same time these companies are concerned about the intellectual property related to their products and they require that all product-related data be handled with high security.

These companies also wonder which parts can be produced by a 3D printing process.

The first task was to found a start-up company together with 2 partner companies and to define the service offering. The Newco developed systems to identify and extract first sets of 3D printable components from ERP-Systems.

Based on current designs a ‘Technical Analyzer’ can decide which components can be printed with different technologies and meet material requirements. In a virtual cloud-based store the components can be requested on demand and be produced by qualified 3D printing companies or by the customer on his own site.

After the successful market entry Naldera sold their shares.

Corporate Finance

Investing in new technologies

Utility and Energy Industries

A leading European utility company considered investing in new technologies to enter the renewable energy market.

Scope of work: Portfolio analysis, development of three alternative market entry strategies along the value chain.

Corporate Finance

'Momentum' market entry

Fashion

An Asian Group wanted to enter the fashion business. They were focused on a German brand. Unfortunately the target had to file for bankruptcy with uncertain outcome. To many creditors with different guaranties and unclear restructuring cost.

Together with a high level fashion consultant we carried out many structured interviews especially in Paris and Milan with insiders of the this business, including Haute Couture Tissue suppliers.

This lead to a completely new assessment how to realize the market entry by a 'Green field Momentum'.

Corporate Finance

Sale and settlement of over 500 companies

Government Advisor for different companies

The BvS (former Treuhandanstalt) was the German government agency responsible for the sale and settlement of former East German companies.

An independent steering committee (Senior Partners from two leading international consulting companies and one Senior Partner from a leading international auditing company) was set-up by the German Ministry of Finance in order to evaluate, negotiate and oversee the transactions.

Throughout three years of work over 500 transactions in all kind of industry sectors were analysed, evaluated and negotiated.

Corporate Finance

Acquisition of Investors

Construction Industry

The owners of a large scale family owned business in the Swiss construction industry asked us to manage the entire transaction process to sell the group of companies.

Corporate Finance

Restructuring & Preparation for US Capital Markets Offering

Oil, Gas, Mining & Metallurgy Ind.

A Russian key supplier of machinery for core industries such as oil, gas, mining and metallurgy (approx. 25,000 employees including additional services as hospitals, hotels, schools) and the Russian Privatization Center required strategic and corporate finance support to benefit from an upturn in the Russian economy and to internationalize the business.

A corporate finance concept in conjunction with a capital increase was developed.

In addition to realize the planned international growth the Company was prepared for a US stock market listing by American Depository Receipts (ADR) together with the core shareholders and an international investment bank.

Corporate Finance

Preparation for Sale

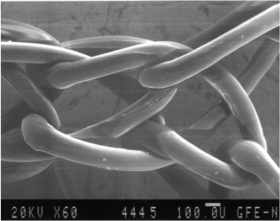

Medical Technology

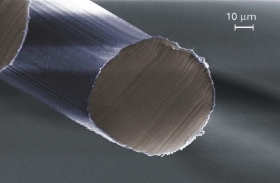

A high tech medical company was prepared for the Private Equity Shareholder for sale.

The company developed a special technology for coating the surface of medical synthetic implants with a nanotechnological layer of Titanium. This vapour deposition is a process for the metallization of complex components as for example hernia meshes realizing an outstanding biocompatibility combined with shorter convalescence.

First the company was enabled to receive all necessary medical licenses for selected most promising products in Europe and especially in the USA. Based on this sales discussions with big US stock listed medical companies were conducted.

Corporate Finance

Recapitalization and Sale

Shipbuilding Industry

When the largest German shipyard filed for bankruptcy, the recently acquired companies in former Eastern Germany had to be separated, recapitalized and prepared under EU law for a second transaction.

All companies could be sold in bidding processes to large international companies especially under the framework of job security for several years.

Corporate Finance

Restructuring and preparation for sale

Shipbuilding Industry, Diesel engines

After the bankruptcy of the largest German shipyard, a subsidiary manufacturing large diesel engines for container ships had to be restructured and sold. The scope included international commerce and the associated spare parts business.

Corporate Finance

Growth strategy and IPO assessment

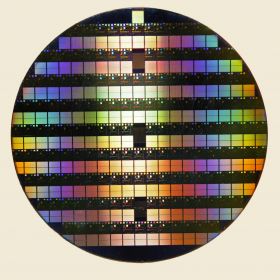

IT Industry

A client in the chip industry pursuing an aggressive growth strategy wanted to expand their capital intensive production base.

The possibility of an IPO in comparison to other sources of financing had to be evaluated together with an Investment Bank.

Raw Materials

Vanadium - Supply with V-Oxides for Master Alloys

Capacity Expansion for a plant in China

Master Alloys are essential for the Titanium Industry.

Key product in this business segment is the oxide vanadium-aluminium. For this reason the secure and cost-effective supply with V2O5 and V2O3 is of high interest. The demand of V-oxides can be realized by own production based on chemical residues of refineries or purchased products.

Vanadium based innovative chemicals improve the insulating and infrared absorbent properties of structural glass and chemical compounds.

Raw Materials

Nickel Mine

Nickel capacity expansion for a Joint Venture Partner in China

The fraction of global nickel production is presently used for various applications as for making nickel steels, nonferrous alloys and super alloys. Nickel is used in many industrial and consumer products.

One of our clients wanted to extend his capacity by buying mines in Canada and in the Inner Mongolia Region. We supported their approach by detailing the action plan and the licensing and the structured financing by American Depositary Receipts (ADR).

Raw Materials

Equipment for processing of Raw Materials

Large construction machinery / mining equipment companies

Senior Vice Presidents of Naldera supported or managed in person as CEO large construction machinery / mining equipment companies.

This included the selection and individual adjustment of equipment for mining projects and the restructuring and sale of a large construction company for the shareholder – a DAX 30 company, diversified with traditional strengths in materials and a growing share of capital goods and service businesses.

Project Management & Engineering

Concept and Realization of an industrial plant in China

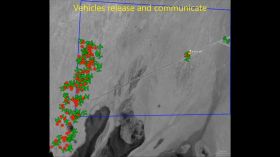

Metallurgy, Titanium Industrie and Aerospace

Following an IPO, a Chinese raw materials company wanted to diversify its product portfolio and build a High-Tech factory producing master alloys for the aerospace, chemical and energy industry. They required an equity partner to conceptualize, manage and realize the ambitious project for them.

A Sino-German joint-venture company was set-up by Naldera with three Parties. Two Chinese companies and one German company (Naldera Materials). Each one third of the equity.

Naldera elaborated the overall concept, the financing approach, the detailed business plan, the market entry concept for China and Russia.

After signing all contracts for the joint-venture in China Naldera started with the basic engineering.

After 3 years the company was build and started successfully with the production of master alloys.

Project Management & Engineering

Center of Science and Economy

R&D Industry and Technolgy Incubator

After the German reunification it was decided to restructure the 'Academy of Science' (over 60 R&D institutes and production facilities, about 22.000 employees). The concept for Berlin-Adlershof was to establish a 'Center of Science and Economy' that is amongst the largest and best in Europe.

After worldwide analysis of market and competition a basic concept was developed including the capital requirements. Production facilities were down seized sold or shut down.

Acquisition of investors including financing concepts under the special political framework at that time with focus on safeguarding jobs.

Successful acquisition of the project 'third generation' of synchrotron radiation / photon source (Bessy II) to the Berlin-Adlershof site.

Project Management & Engineering

International Airport Infrastructure Investment

Infrastructure, Capacity Expansion

An international airport wanted to increase its passenger capacity by adding another runway and investing in the airport infrastructure.

Configuration of an interdisciplinary project team and time schedule, airport-specific integrated business plan model with 30 years planning horizon, forecast of revenues and operating costs, determination of capital budget and funding requirements.

Project Management & Engineering

Development of a new generation of diesel-powered locomotives

Logistics, Transportation, Railway

The government client required a new generation of diesel-powered locomotives (new processor based control systems, wear less electrical traction motors, diesel-hydraulic drives).

Based on these requirements a consortium of railway specialist and suppliers was formed, prototyping, tests, serial production for different state owned and private railway companies, high degree of relocation of production to the investors / buyers.

Project Management & Engineering

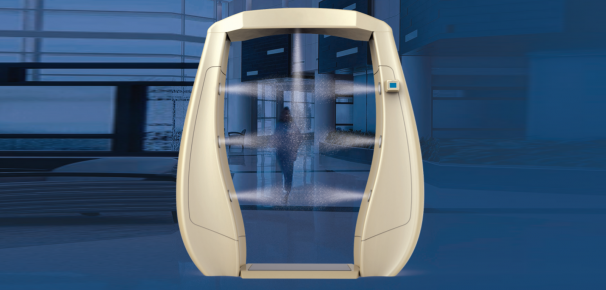

Concept of new Desinfection Systems - Start-up Company

Health Care Industry

Since beginning of 2020 Covid-19 has changed our way of living. In this context different decontamination systems like tunnels, robotics etc. for hospitals, retirement homes, warehouses, commercial centers, airports etc. are tested for mass neutralization of viruses and bacteria.

Innovative solutions for neutralizing viruses (including Covid-19) and bacteria on people and equipment are often based on nebulizing a medical standard alcohol-based liquid and / or on using UV-C radiation.

Scope of the work: At the request of an international trading and distribution company and in cooperation with a Turkish manufacturer we developed a modular tunnel system.

Its main goal was to disinfect people at the most important points of a building, arena or facility. The obvious solution was a disinfection tunnel through which visitors, employees or public traffic of many kinds can pass.

The advantages of disinfection tunnels are a significant risc reduction in public places without the need for support personnel.

Because of permanent changes of government requirements the project was stopped.

Project Management & Engineering

Concept and Blue Print of a 3D System House (3DSH)

IT / Manufacturing Industry

Based on the request of an IT Supplier for a Defense Company we developed a blueprint for a 3D System House similar to the successful operating principle of system houses / circuit design centers in the micro electronic market.

The 3DSH – Concept is based on the following technologies:

Big Data Systems, New Algorithms, Artificial Intelligence (AI), High Security Cloud Solutions, New Blockchain Technologies, Customer Intimacy

The 3DSH is a Value Added Service Provider connecting industrial Production Companies with 3D Printing Companies or stationary 3D printers on ships.

The key elements are 4 Modules: Economic Analyzer, Technical Analyzer, Cloud Parts Inventory and High Security Cloud.

These 4 modules are based on existing technologies that have to be integrated in one system.

Project Management & Engineering

Armoured air-portable tracked vehicles

Defense Industry

For the German Rapid Reaction Forces the defense ministry required a family of armoured, air-portable tracked vehicles (anti-tank, anti-aircraft, reconnaissance, command and control capacities).

Scope of work: Formation of an industrial consortium of tank specialists and suppliers, design and prototyping by maximising the use of commercial parts, successful tests with military authorities, order to the consortium.

The serial production started with two versions of the vehicle (gun and anti-tank missile), construction and tests of the extended family of vehicles (reconnaissance, ambulance, air-defence, command/control).

In total 450 vehicles in service in Europe and the US-market.

Comparable success story with Leopard 1 and Leopard 2-MBT-family